(Yes, I am absolutely stealing this idea from Cullen. Go read his, it’s great.)

1) Many (but not all) roads lead to Rome.

“We” in the investment business like to discuss and debate the finer points of factor models and small/value tilts and tax loss harvesting and rebalancing strategies and global allocation and treatment of real estate and the merits of backtested portfolios. And it’s fun. But mostly we are splitting hairs. There are a ton of smart people out there looking at this data on a regular basis, trying to winnow a small advantage over time. There are probably 37 different academically validated ways to capture the value premium (P/B, P/E, CAPE, EV/EBITDA, dividends, etc) and which one you choose isn’t super important. Most diversified portfolios perform in a very similar way over time. Discussing the perceived advantages of one low cost, broadly diversified strategy over another is a good mental exercise, but really we’re all relying on historical data (which may or may not hold true in the future) and our own assumptions going forward (which are all but guaranteed to be wrong). It is much, much more important that you stick with your strategy than worry about which one you choose. There are certainly some terrible ways to invest, but there are a great many good ones as well. So be a Boglehead 3-fund portfolio investor or a Swensen portfolio guy or a DFA adherent or a quantitative value investor, but don’t keep changing lanes every year. Minimize your costs, keep activity low, watch your taxes, behave and the odds will be on your side.

2) Permanent pessimism kills.

I’m not saying that everything needs to be sunshine and roses every day, but if you can’t generally agree that the world is becoming a better place and that capitalism has a part in that, you’re not going to have much luck as an investor in the long term. If you let your political feelings blur your vision or tell yourself a story that the end is near, you’ll end up paying for it. This is why my friend Josh talks about having optimism as a default setting. Yes, sometimes things are bad. Recessions are real. Bear markets are painful. But they do end. Markets recover, new businesses are built from the ashes of failed experiments and those who refused to change over time. People keep going to work, inventing things we didn’t know we needed and squeezing new efficiencies from markets. We keep raising families, building lives, improving ourselves and our communities. Believe it.

3) Investing well is always hard.

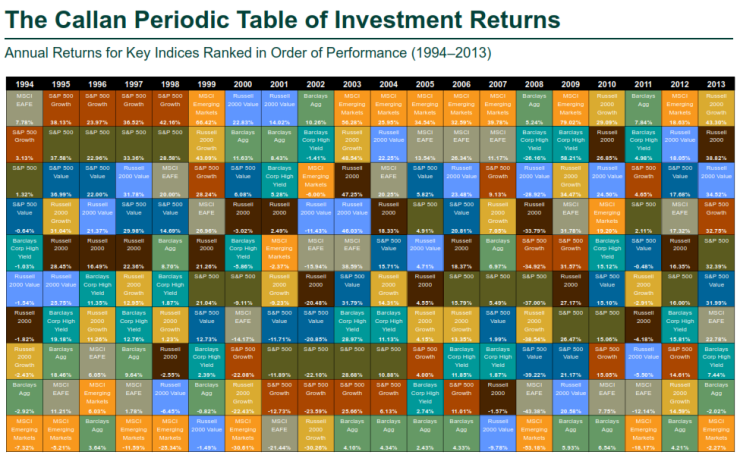

In any market environment, something will challenge you. This year it was owning any international stocks. Or energy, or short-term TIPS or short-term bonds in general. Emerging markets go in there too. Lots to not like this year. The story was mostly the same in 2013, but you also got to really not like REITs and long term bonds. Of course, if you had sold REITs and long term bonds at the end of last year because they “weren’t working,” you would have missed out in 2014. Pick a year and find an asset class that was hard to own that year. Here’s the annual difference between the top performing asset class and the bottom performing asset class for the last 10 years, from the Callan table.

| Year | High – Low |

| 2013 | 45.57% |

| 2012 | 14.42% |

| 2011 | 26.01% |

| 2010 | 22.55% |

| 2009 | 73.09% |

| 2008 | 58.42% |

| 2007 | 49.56% |

| 2006 | 28.26% |

| 2005 | 32.11% |

| 2004 | 21.61% |

By the way that is an average difference of 37.16% that you “missed out on” by being diversified, and emerging markets were either at the top or the bottom in 9 of the last 10 years.

The more I learn, the less I seem to know. Maybe next year I’ll have four things.